September is generally a tough month for bitcoin and other digital assets… but soars in October. The Fed just accelerated the process.

Bitcoin (BTC) has surged after the U.S. Federal Reserve announced a slew of measures to protect traditional finance from last week’s brutal swings — but what is really going on?

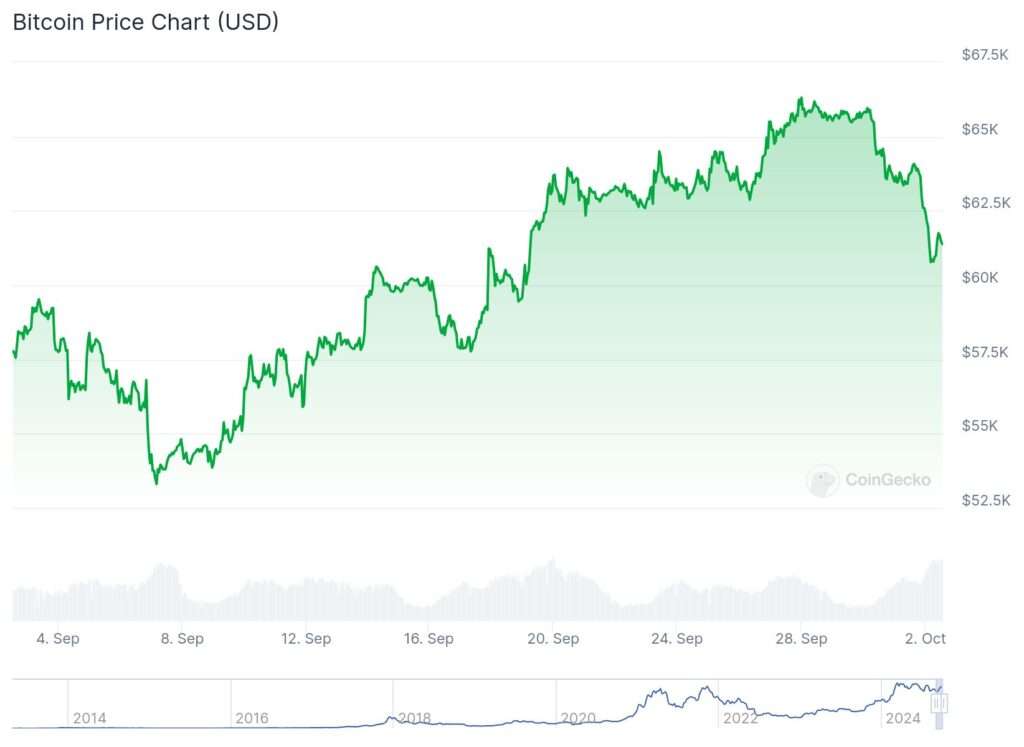

CoinGecko says the price of the largest digital coin is now $63,199 per coin and is up over 6% in the past 24 hours.

According to CoinGlass data, short squeezes have wiped out over $154 million of shorts across all crypto within a single day. The vast majority of which (just under $74 million) were Bitcoin positions.

Short positions are taken by investors who expect the price of an asset to fall. Once the short is liquidated, this means they had a losing bet and their position is closed.

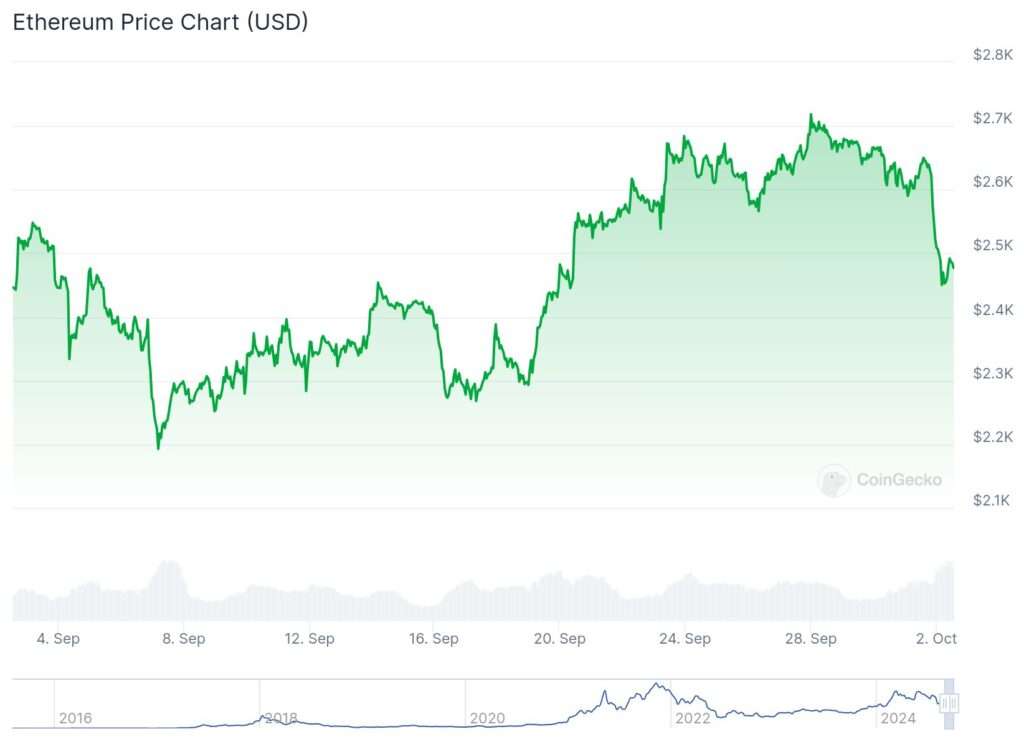

The ebb and flow of the rest of the crypto market has also been far higher than a year ago. Ethereum-based token price hits $2,437 per coin; Gained over 6% in the past 24 hour Short positions to $33 million in assets have closed

The Federal Reserve, who has raised interest rates to a 23-year high in 2022, made the reduction as low as 50 basis points on Wednesday. This has caused a subsequent rally in Bitcoin and other cryptocurrencies, as well as crypto and tech stocks. Low interest rates are also tailwinds for riskier investments such as digital assets and U.S. equities, which often outperform in such conditions.

Historic approval for exchange-traded funds (ETFs) that gave traditional investors an on-ramp to the coin sent bitcoin soaring to a record high of $73,737 in March. The agency has failed to meet that pace on an annual basis since.

September is typically a negative month for stocks, historically speaking (data ahead)—and Bitcoin broadly follows that trend, with the worst monthly average price action over 11 years. However, October and November are typically one of the best months for Bitcoin; it could be an early start to the so-called Uptober swing thanks to the Fed.

Disclaimer: The information provided on this website is for educational and informational purposes only and should not be considered financial, investment, or legal advice. Stock markets, real estate, and other financial instruments involve significant risks, and past performance does not guarantee future results. You should conduct your own research and/or seek advice from a licensed financial advisor before making any investment decisions. The website owner is not liable for any financial losses or damages arising from the use of the information presented here.