Dan Zanger

Dan Zanger is one of the most interesting traders in the contemporary trading world. With 10 golden rules, Dan Zanger turned $10k into $42 million in 2 years.

In December 2000, in an article titled “My Stocks are Up 10,000%” in Fortune magazine, the U.S. Internal Revenue Service confirmed that Dan Zanger had set two world records: First, for portfolio growth in one year: 29,000%. Second, in less than 18 months, Dan Zanger turned $10,775 into $18 million, equivalent to a 164,000% return. Finally, his account reached $42 million after 23 months.

Dan Zanger was born and raised in San Fernando Valley, Los Angeles. He began participating in the stock market in 1976 while working full-time in the pool construction industry. His life changed when he attended a seminar by stock expert William O’Neil, author of the famous book “How to Make Money in Stocks”. O’Neil greatly influenced Dan Zanger. However, Zanger is not a pure CANSLIM trader. Struggling for 10 years studying stocks, Dan Zanger blew up his account three times. Finally, he discovered the trading formula “Price chart, price, and volume” rather than relying entirely on CANSLIM. In 1997, he sold his Porsche to get nearly $11,000 to enter the stock market. What happened next became history. In 1996, Dan Zanger founded the Chart Pattern website.

DAN ZANGER’S 10 GOLDEN RULES

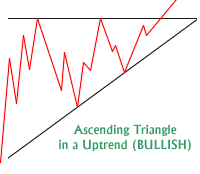

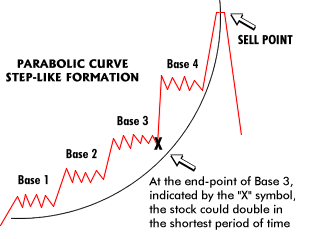

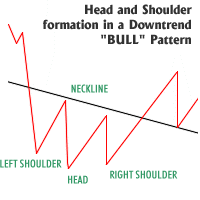

1. Ensure the stock has formed a good price base or a pattern described on his website www.chartpattern.com: (cup-and-handle, horizontal base, triangle, parabolic curve, symmetrical triangle, wedge, flag pattern, price channel, and head-and-shoulders).

2. Buy the stock when it breaks out of the trend line of the base or pattern (called the breakout point) and ensure volume is higher than the 30-day average. Never buy more than 5% above the trend line.

3. Quickly sell the stock (cut losses) as soon as it returns inside the trend line or breakout point. Usually, I set a stop loss $1 below the breakout point. For high-priced stocks, it can be a bit more, but never use a stop loss greater than $2.

4. Take profits on 20%-30% of the position when the stock price increases 15%-20% from the breakout point.

5. Hold the strongest performing stocks for the longest time and sell the slower or weakest performing stocks in the shortest time. Remember, a stock is only good when it’s rising in price.

Example: Hold this stock as long as you can

And sell this stock as fast as you can

6. Identify the leading group of stocks and follow them (Follow the Leader).

7. After the market has risen strongly for a long time, your stocks are very likely to reverse (which often happens quickly and unexpectedly). Therefore, learn to look for higher trend lines and learn price reversal patterns to help you exit at the right time.

8. Remember that volume is needed for price movement, so start studying the volume behavior of stocks and then see how price reacts to sessions with sudden volume increases. Volume is key to knowing whether a price increase will be successful or not.

9. When a stock gives a buy signal, don’t rush to buy immediately. First, you must observe the price action and combine it with the volume of that day.

10. Never use margin until you are proficient in the stock market and in controlling emotions. Margin can wipe out your entire account.

Conclusion

Dan Zanger’s extraordinary journey from a modest investment of $10,775 to an astounding $42 million in just 23 months serves as a compelling testament to the power of disciplined trading and strategic risk management. His 10 golden rules encapsulate essential principles that can guide traders at all levels in navigating the complexities of the stock market.Zanger’s emphasis on chart patterns, volume analysis, and emotional discipline underscores the importance of a systematic approach to trading. By focusing on well-defined entry and exit points and maintaining strict stop-loss measures, traders can protect their capital while maximizing potential gains.Moreover, Zanger’s story highlights the value of continuous learning and adaptation. His ability to evolve from initial failures into a highly successful trading strategy demonstrates that perseverance and a willingness to refine one’s approach are crucial for long-term success in the markets.Ultimately, aspiring traders can draw inspiration from Dan Zanger’s methods and mindset. By implementing his rules and cultivating a disciplined trading practice, individuals can enhance their chances of achieving their financial goals in the ever-changing landscape of stock trading.

Disclaimer: The information provided on this website is for educational and informational purposes only and should not be considered financial, investment, or legal advice. Stock markets, real estate, and other financial instruments involve significant risks, and past performance does not guarantee future results. You should conduct your own research and/or seek advice from a licensed financial advisor before making any investment decisions. The website owner is not liable for any financial losses or damages arising from the use of the information presented here.